The period after midterm elections often are filled with a flurry of bills and resolutions filed on behalf of constituents' direct needs. Even after the partisan nature of elections, the weeks following can be one of the most productive periods of Congress, no matter who wins the midterms. There is less stumping and more thinking, but the calendar is tight, with the holiday season approaching.

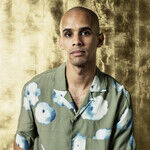

So we don't want Rep. Neal Dunn's veterans GI legislation to get lost in the pile that never sees the light of day as the session nears an end.

HR 7119 calls for an extension of time during which the Department of Veterans can continue to pay educational benefits — even if schools are closed, as some have been after Hurricane Michael.

The bill has so far been referred to the U.S. House Committee on Veterans Affairs. If nothing else, the introduction can provide an incentive for the VA to ensure veterans receive the benefits they've earned during a trying period, despite existing federal regulations that don't account for hardships like a hurricane. It might be something that needs to be followed up with future legislation that includes provisions that take natural disasters into account.

Veterans fought for our country, and they deserve to get their benefits no matter the circumstances over which they have no control.

Smart Doves at the Fed

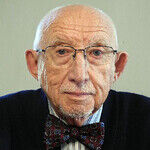

Markets have been on the upswing, and a Wednesday speech by Federal Reserve Chairman Jerome Powell should keep them going in that direction.

Powell cited the uncertain future of the Brexit deal, which has been tossed back and forth on the other side of the pond, as a reason he sees the benchmark rate remaining near "neutral" for at least the near term.

That's the right call. Inflation is in check, and it's prudent to attract investment to stocks as the millennials consider what they want to do with their money and retired Baby Boomers decide whether they should start withdrawing from the market. We want them to stay in, and a slowing of rate hikes should help keep the market hot for at least a little while longer while certain uncertainties — the trade war with China, the U.S.-Brexit question — simmer. There's no reason to disturb a bull market and add more possibilities that, dare we say, could spook investors.

Comments by the Fed chairman usually move the market, so comments can be tailored to keep a market hot, and Powell no doubt knows this. The dollar may drop in the short term, but it's the trade war that will have a greater effect on the value versus other currencies. Combined with the recent announcement of auto-worker layoffs, you have a market that could go in either direction, so a neutral outlook seems like a best bet.

REPRINTED FROM THE PANAMA CITY NEWS HERALD

View Comments